A new industry for New Zealand

Information Technology (IT) is one of the world’s fastest growing and important industry sectors. Electronics, telecommunications, computers and software in particular are key elements in Information Technology. Figures commonly quoted range from 30 to 50 per cent growth per year in many parts of the industry.

There are at least two aspects of this growth of IT. One is the new opportunities and job creation in the IT industry itself, the number of people providing hardware, software and services will grow. The second, more important, aspect is the productivity increase and other advantages to industry and commerce in general brought about by using new IT techniques. Examples are the productivity gains in a legal office through using word processors, the speed of response in banking and money markets through using on-line international data links, and the efficiencies of using computer design and control in manufacturing processes. The productivity improvements possible range widely but the norm seems to be at least 100 per cent.

The importance of IT can thus be seen, both as an industry itself and as a productivity boosting technique for other industries and commerce of all types. The question is, how can New Zealand take advantage of these opportunities?

If we examine the trends of the last five to ten years we find them taking many new and unpredictable directions. One disturbing trend is the increasing pace of change. In the past people have had a generation or so to absorb big changes in technology and the consequent social changes. Now quite marked changes occur over a two-to-three-year span. Examples are the advent of the pocket calculator and cash register for school and retail use, the credit card and money dispensers, and the dramatic use of the microcomputer in many applications. Adaptation to change is less rapid. It takes time to develop an infrastructure of suppliers, servicemen, training facilities, consultants and technical information.

To survive, New Zealand industry and business has to be able to absorb the new IT technologies and use them to advantage, at least as fast as its competitors. In general, New Zealanders are good at rising to this sort of challenge. However, it is often a result of individual efforts and the average company lags well behind the innovators. We are individualists and not so good at collective, strategic planning.

As regards the new opportunities for marketing products of the IT industry itself, we have to make quicker progress and work together more readily. Because the IT industry is new and dynamic it can change more rapidly. It is generally recognised that New Zealand cannot expect to make breakthroughs in design or manufacture of large numbers of high technology electronics products such as television sets, video recorders, or microcomputers, nor in the design and manufacture of mass produced silicon chips. Some countries and multinational companies are leaders in high-tech, aerospace and electronics applications. They pour so much money into research and development, production facilities, and marketing that we cannot compete in these fields. However, we can do pioneering work and achieve worthwhile production runs through winning markets in specialised areas — the so-called ‘niche’ philosophy.

On the hardware side, we have produced and sold overseas specialised microcomputer-based equipment; petrol pumps, electric fences, and motor speed controls. With the DSIR Physics and Engineering Laboratory’s new Silicon Facility, custom chips can be designed and manufactured here in New Zealand, thus shortening the development time and getting to short-lived markets quickly. The product design will also be less vulnerable to piracy.

However, I believe that it is the software development and services side of IT that New Zealand can really make into a new industry. For example, software development in selected areas; or consultancies based on practical experience with smaller industries (which are now getting into computers world-wide). Also in other service industries such as information storage and processing, and the recently highlighted ‘learning’ industry.

More of these opportunities later. Let us now consider the existing marketplace and our strengths and weaknesses.

Firstly, we must look historically at the role of governments in relation to industrial development in New Zealand. Protective barriers were put up to give local industry a start. These barriers were often quantitative licence controls but we are now changing more to tariff barriers (e.g., incoming goods have to pay a customs duty of a percentage of their cost). The widespread reliance on protection by licence has left industry generally with an attitude of charging whatever it costs them to produce items plus a profit margin. The local market has been shared out; there has been a lack of aggressive marketing and competition in many (though not all) industries. Government has been looked to for protection against competition from other countries, and for subsidies to help exports compete. A 1980 DSIR survey of the manufacturing industry showed many companies even look to government for overseas detailed marketing information! Government incentives and subsidies have been broadly targeted, so ‘poor’ exporters as well as ‘good’ exporters, for instance, have been helped with subsidies. Government officials are reluctant to try to ‘pick winners’ and select industries to encourage. New Zealand exporters have not in general worked closely with each other, or with government, except for some primary sector producer boards.

This has left us with a wide range of organisations in each industry — some good performers, but many not really under pressure until recently to improve productivity in order to survive. Few industrial organisations have, until the last three to five years, had experience competing in overseas markets.

The government’s role in providing background assistance and a ‘good’ environment must not be forgotten. The spending on education at primary, secondary and tertiary levels has produced a well-educated workforce by world standards that has a relatively low wage structure. A relatively high percentage of our students go on to polytechnics and universities. Our public sector infrastructure is well developed, our technical services, such as the Post Office telecommunications, the broadcasting services, the Ministry of Agriculture and Fisheries, and the DSIR, are good for our size of country.

It is difficult to generalise about the private sector in New Zealand having, as it does so many industries and range of size of companies. The DSIR survey of the New Zealand manufacturing industry in 1980 showed we had less large companies as a percentage of our total than in many other countries. The study also showed we have innovative companies, many small in size, who succeed in exporting their products and services against international competition. In world trade terms we are small, with only a fraction of one per cent of world trade. Even our large primary industries are small in terms of total world production and trade. These primary processing industries, meat, wool, dairy, etc, have learned to harness the efforts of individual farmers, through co-opera-tives and co-ordinated overseas marketing, to take more than a proportional slice of the world external trade in their products. The manufacturing sector is growing rapidly as an earner of overseas exchange, but the 25 per cent of total exports claimed in recent years includes some further processing of primary produce such as timber, pulp, food, carpets, etc.

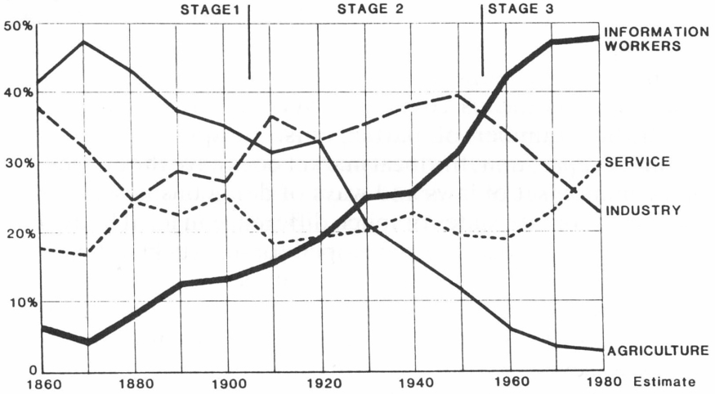

The service sector in many countries is growing while the agricultural and manufacturing sectors are falling (see Figure 10.1). The information handling and processing sector is the largest employment sector. A recent OECD report shows that about 40 per cent of the ‘economically active’ population (i.e., the work force) is engaged in information occupations in OECD member nations. New Zealand, by the way, is well up in the field in this regard.

Figure 10.1: Four sector aggregation of the US work force by per cent 1860–1960 (using median estimates of information workers).

Porat. “The Information Economy” US Dept of Commerce based on Census Bureau and Bureau of Labor Statistics

The message is clear. Growth of employment is in the ser-vice and information handling sectors. Barry Jones (now the Australian Minister of Science) makes this clear in his book Sleepers Wake 1982. The other sectors use productivity raising technologies and need less people to sustain food production or consumer/industry material needs. There is some evidence from Figure 10.1 that the employment percentage in the information handling sector has peaked. The use of data processing equipment like computers, is reducing the number of direct employees, as has happened in agriculture and industry. The demand for software to drive these ubiquitous computers turns towards more productive, sophisticated, user-friendly designs. As the service sector continues to grow, the demand for software to provide specialised services will grow too.

Development of software is an activity where New Zealand can compete in world markets and also assist its own business and industry sector to improve its productivity and competitiveness. Software is very much a growth industry.

The local market for New Zealand software is, however, small even though our national use of computers is relatively high by world standards. We have clusters of population separated quite markedly by distance. Thus marketing, servicing and support of a product is expensive and diffuse. Any ‘vertical’ marketing (to one industry or activity, e.g., pharmacies, travel agents) means covering several centres to achieve a worthwhile number of participants. In spite of this geographical separation, the local market does have the advantage of a common set of laws and ways of doing business. It does not have separate states or much difference in local body regulations. Thus a package developed for an Auckland organisation can easily be used in other centres.

However, there is an independent streak in most New Zealanders. They like to develop their own way of doing things and even to write their own software. They also tend to be wary of software (and other items) developed in New Zealand and often look to overseas suppliers. This is particularly noticeable with those companies who subscribe to overseas journals and whose senior staff make frequent overseas visits. Recent local developments of New Zealand-written software and a rise in professionalism and quality might not have been noticed by some organisations purchasing software. This characteristic of preferring NIH (not invented here) products is not confined to software purchasers! The local industry must counter these attitudes by active directed marketing.

Several New Zealand companies have put together good suites of software packages and, with good marketing and support, have won a reasonable share of the New Zealand software market in accounting/inventory applications on microcomputers. Other success areas are locally written production orientated packages, and remote on-line transaction processing and communications.

Looking overseas, we find that New Zealand is not well known for its manufactured or technology products. A few breakthroughs have been made in the world scene, mainly in specific narrow markets. The present higher profile of New Zealand products, from kiwifruit to electronic petrol pumps to software generator tools, will do a lot to help marketing products, provided the product quality and continuing supply and support can be maintained. A few shoddy goods, marketed by amateurs and not followed up, can undo all the good work.

We have strengths in certain markets and in some types of industry. We are innovative and flexible and have an educated workforce. Our systems and legislation are similar to the English model used in many countries, and we do speak English. But we must be aware of the weaknesses, the small scale of our society, our cultural narrowness (compared with countries with varied immigrants), and our distance from the marketplace.

Many of the general features discussed above also apply to software development and exports. But in the computer and software fields many other countries are ahead of us, both in the breadth of their applications and the attitudes of their business and industrial users.

An early sample from a survey I conducted for the DSIR (in August 1984) revealed some interesting perceptions of the strengths of the New Zealand software industry, by people in the industry. The major strength was seen as New Zealand’s comparatively low wage costs for software development staff and the flexibility and skill of staff. Other factors featuring high on the list were our good quality software and design skills, our efficient use of computer hardware and success in the marketplace. Factors expected to encourage future growth were, reduction of sales tax, government incentives and improving marketing skills. Better availability of capital was mentioned, as was improving staff training and reducing hardware costs. One factor not mentioned by many, but which I feel is significant, is the closeness of the user and software developer. Both physically and organisationally they are closer than in other more populous and structured countries. This closeness can speed up development and improve ‘user friendliness’ in the software.

Whether these perceived strengths are real in competitive terms, compared with other countries, can only be tested in the marketplace. They seem to agree with comments of overseas visitors coming here. A marketing strategy builds on the strengths of a product or service, watches for shifts in the competition or marketplace, and also plans to reduce the effect of weaknesses. But above all, the ‘pull’ of the marketplace needs to be assessed and ‘niches’ identified.

The same survey highlighted the weaknesses of the New Zealand software industry. Some of these are self-evident, e.g., distance from the main export markets, lack of infrastructure due to small home market, etc. Others are more subtle, such as the small size of individual software companies and lack of co-operative efforts. According to the survey figures the software staff of the 200 organisations writing software for sale was only about 800 people.

Other survey results showed most people thought that our poor overseas marketing was the biggest weakness, followed by a lack of confidence (and of credibility) and inexperience. Poor management skills and high overall costs were also mentioned. Feedback from the successful and unsuccessful marketing efforts for New Zealand software overseas is sadly lacking. One or two companies have made their experiences known to others in the industry. A New Zealand Computer Society Seminar on Exporting of Software was held in conjunction with the 1983 Conference. It was of some value, and the first in New Zealand. We need more. More people must become involved in sharing their experiences, collectively working out a New Zealand software marketing strategy and then taking action.

Most New Zealand companies do not use people based overseas to market their software, relying on casual contacts and occasional visits by New Zealand-based staff. Spending on marketing averages perhaps four per cent of sales in New Zealand and about five per cent of sales overseas; excluding a few spending a lot on market development. These figures appear to be relatively low in an industry where several demonstrations may be necessary to clinch a sale and where there are so many apparently similar products on the market. Market development costs can, at present (1984), be claimed as a tax credit, and market development grants are available.

After poor marketing skills the major factor hindering growth of the New Zealand software industry is the lack of experienced staff. Our training organisations produce some good people, but not enough have practical business experience or appropriate computer language skills. Many leave the software sector or go overseas rather than work in New Zealand. The reluctance of companies to train staff for themselves also showed up in the survey. They relied on getting trained staff from elsewhere, often other New Zealand companies. Also, the average time spent on training for software writers in employment was only one week per year which, in view of the rapid changes in the industry, seems very low.

Another weakness frequently mentioned is the high cost of capital. It seems software is not yet considered a worthwhile or ‘secure’ product for investment. There are several factors at play here. Assets in the form of developed software are often not recognised by the software companies themselves, let alone by the financial community! A surprisingly large amount of time has to be spent in writing good software and thus development costs appear to be disproportionately high. It has never been easy to persuade financiers to invest in brain power. Also, the high occurrence of software piracy and short life of the product may influence the financiers’ view on the chance of getting a good return on their investment.

In spite of the weaknesses, the industry has had some notable achievements, particularly over the last few years. New Zealand-written software has been sold for many years; some of the organisations covered in my DSIR survey had sold New Zealand-written software for ten years or more. Half the companies selling New Zealand-written software had been selling it for three years or less. Three-quarters had been selling it for less than five years. On the whole, selling local software is a very new industry for New Zealand. Local sales of New Zealand-written software were about $15 million in 1983 according to my DSIR survey. Over 200 organisations are writing software for sale. Exports are harder to monitor, but early examples include Progeni (school timetables in 1972), IDAPS (insurance packages — late 1970s), ACP and Intec (accounting packages — late 1970s), Mana Systems (operating systems — 1980), and Progeni (software generators — 1980). Exports of software in 1983 were between $5 million and $7 million according to my DSIR survey. Forecasts for 1984 and 1985 indicate that at least 50 per cent growth is expected. About 50 organisations are currently exporting New Zealand-written software.

Many New Zealand software writers are working overseas and seem to have little problem getting jobs. Indeed, many organisations recruit New Zealand-trained people. A few New Zealand software companies have established branches overseas in America and Australia. Some Australian bureaux and software companies have been taken over by New Zealand companies.

1984 and another Christchurch software developer moves into the international market. Adata of Christchurch produces the Exsys operating system taken up by Data General for marketing around the world. In the photograph Adata founder Rodger Nixon witnesses the first New Zealand sale. From left, the secretary of the Farmers Cooperative Organisation Society, and Don Smith of Data General.

With the marketing of the LINC New Zealand-developed system through the multinational company, Burroughs Ltd, New Zealand software has won world-wide sales. Even at a price of about US$40,000 over 1000 sales had been made in under two years. Some purchasers know it came from New Zealand but not enough are aware of this fact. Now Adata Software have designed an advanced system for software development, EXSYS, and Data-General Ltd are assisting in marketing it world-wide. Other multinationals like Digital Equipment Ltd, with their Technology Village software development facility, and IBM with their local software procurement programme, are actively seeking New Zealand-written software for marketing world-wide.

One of the questions asked in the 1984 DSIR survey of the New Zealand software industry was ‘Who do you think are the leading New Zealand-based software development companies?’ The clear leader here was Progeni Systems with over half of respondents naming them in the top three. Second came Interactive Applications Ltd, third were Burroughs/LINC, and fourth CBL/Datacom. Other companies named were Computer Consultants, Adata, IDAPS and the Paxus Group (includes IAL and IDAPS). The research did not differentiate whether the companies did in fact produce innovative software or were just good at marketing their product. The top named companies were also the leading exporters of New Zealand-written software. They were also quite large by New Zealand standards.

The industry is maturing rapidly. Over the past few years there has been a definite trend towards amalgamations and the formation of groups of companies. The New Zealand Insurance Computer Group (NZ South British/Paxus/ IDAPS) has acquired several important New Zealand and Australian computer and software companies and now has over 600 employees. Andas (Armstrong & SpringhalllPowercorp) has also emerged as a big group of computer companies, including software development specialists. This trend, with the other moves by New Zealand software companies to market through multinationals, has given the New Zealand software companies access to finance and, more importantly, to mature marketing skills and overseas representation.

Another interesting development has been the trend for multinationals to release new hardware in New Zealand earlier than before. The Apple McIntosh, for example, was available in New Zealand only a few months after its release in the United States. This enables our software people to develop software for the new types of computer much earlier than previously. This, coupled with the fact that it does not take much capital to set up a software development company, means that New Zealand companies can be up with the world leaders in software much more easily than in most other industries. We do not make enough of this advantage!

The Industries Development Commission study of the New Zealand electronics industry has helped raise the profile of professional electronics and software. Some government funding is now targeted into electronics and software. Other Research and Development funding recognises the importance of electronics, computers and software. This gives the industry some credibility and must help attract private investment and venture capital. There is also more awareness of ‘hi-tech’ products in the community and industry as microchip-based products and machinery become more common. We now have some microcomputers in most secondary schools.

There has been a realisation that New Zealand has got good facilities, well-educated and trained people who can quickly be productive in these new industries. Responses to the survey showed that about 40 per cent of staff writing software for sale had a degree level qualification! With our multicultural society and good relations with many less well-developed countries we have a unique position in developing consultancies and a ‘learning industry’. We can get close to people in many countries yet we have the advantage of English as a language — the most universal language. The harnessing of computer, video and storage technologies with our well-developed ‘remote’ teaching skills (e.g., correspondence schools and technical institutes) could be the start of a new ‘learning’ industry.

The trade associations and societies connected with computing have become more professional. Some have appointed paid executives and undertake educational and promotional work in addition to the narrow ‘self interest’ activities of earlier years. Their promotion of ethics, standards and professional liability is helping to turn computing into a recognised profession, and to improve the public image of staff and companies. Organising training and professional development seminars is helping to raise the level of knowledge of existing practitioners. There has also been more involvement with international computer organisations and conferences. The importance of the Australia/Asia/Pacific computer and software industries has been realised and more efforts are now being made to make contacts here. Showing one’s product at trade fairs and exhibitions has become common now in New Zealand, but not yet frequent enough overseas. Cooperative efforts here, involving the Department of Trade and Industry, could be of great importance to New Zealand software exports. The various associations like the NZ Computing Services Association (CSA), the Computer & Office Products Industry Federation (COPIF), and National Electronics Development Association (NEDA), together with the NZ Computer Society (individual membership rather than organisations) must be careful not to overlap or be too fragmented. Most now have observer status at each other’s meetings, which is an excellent start to the co-ordination of their efforts on behalf of the industry.

But while we have undoubtedly been developing, the rest of the world has not exactly been standing still either. The development of computer and software industries in Australia has been noticeable in the last few years. Government influence has been significant and there has been specific assistance in some cases. The ‘hi-tech’ theme has been promoted there, particularly since the election of the Australian Labor government in 1983. However, there does seem to have been some fragmentation and duplication in the Australian software scene between representative organisations. They also have a problem of geographical separation of the main cities and the rivalries of different State activities.

The recent formation of the Asean-Oceanian Computer Industry Organisation is a significant step in international cooperation. Singapore has declared its intention of becoming the software centre of the Asia-Pacific region. In its usual determined style the Singapore government has initiated some impressive projects. New Zealand must become involved in all these areas. So far most participation appears to have come from the personal initiative of a few people rather than planned action by the government and industry.

Further afield we find the computer and Information Technology industries growing very rapidly. Every couple of years some major change occurs which influences the direction of the whole industry. Some recent significant changes have been the advent of 16 and 32 bit processors, high quality graphics, the ‘user friendly’ ‘user driven’ software and, of course, the dramatic rise in the use of stand-alone microcomputers as PCs (personal computers).

A more strategic stage has now been reached, with several countries taking significant actions to move their computer industries towards stated goals. The influence of the countries who lead the world in Information Technology has been realised. The Japanese have moved into computers relatively slowly in the world scene, but now with their ‘fifth generation’ project have set their sights on leading the world. The goals include man-machine interfaces, expert systems and artificial intelligence, VLSI circuit advances and software development. The project is a partnership of government and industry with massive funding.

Other countries, who have in the past relied more on individual company innovations and progress by competition, have seen the need to co-ordinate their industries to avoid duplication and to match the expected progress of the Japanese. The United Kingdom government took a deliberate step in IT promotion with public awareness programmes, industry microelectronics subsidy schemes etc. The success of these IT awareness programmes can be seen in the change of attitude of the public, industry and business. It was a classic case of marketing concepts, leading to a demand for the product. The United Kingdom ‘Alvey Report’ follows this up with a programme of funding and organisation in the ‘fifth generation’ direction. The United Kingdom government will be spending hundreds of millions of pounds on IT over the next five years.

The EEC nations have an ‘ESPRIT’ plan for a European ‘fifth generation’ project. France has also set up some ambitious independent schemes for its computer and software industry.

In America, which still dominates the world computer scene, some of the leading companies have seen the urgent need for co-operation to meet the threat of other countries’ national plans. Companies like Digital Equipment, Motorola and National Semiconductor are now working out joint research programmes in the MCC (Microelectronics and Computer Technology Corporation) launched in 1983.

The strategic nature of the planning and the setting of targets by national bodies, indicate the computer and software industries are maturing. It could now be the right time to plan New Zealand’s place in this world of IT, with its importance to all forms of world trade. In the past, New Zealand has been at a disadvantage in the computer industry, because of the large amount of money needed to make advances in computer hardware and particularly in silicon chip design and manufacture. We have been users of the new technologies rather than developers. However, now that software has become so much more important, New Zealand’s role can become that much more significant. Software can now amount to between 50 and 80 per cent of the cost of a computer project. Software development does not need such a large investment in basic research or capital equipment as hardware or electronic chips.

Providing that we can identify market requirements, provide good quality software quickly and give on-going support, New Zealand can win export orders for its software. Distance from overseas markets is not an insurmountable problem. The technique of ‘niche’ marketing is applicable rather than attempting to take on the world on a broad front. In addition, some co-ordination of marketing is required. Too often, individuals and companies are adopting a ‘go it alone’ policy. They find the going tough after the initial few sales and crash out, spoiling the New Zealand image. Some of the New Zealand primary product marketing boards have done a good job co-ordinating the efforts of energetic private entrepreneurs in their industries, while retaining the overall benefit for the industry. Strategic planning of marketing, the setting of objectives, and marshalling resources take time and goodwill among the participants. It seems a role for an industry-led co- operative with some government support and backing. It needs the New Zealand software industry to come up with some specific proposals, and to get their member companies’ commitments to such a proposal before it can go further.

The respondents to my 1984 DSIR survey of the New Zealand software industry gave support to this concept. Improving marketing skills, co-operation and action by the trade associations featured in both home and overseas markets. But in exports the expectation was that government should also provide incentives and market development assistance. In answer to the wider question ‘Who should take up these ideas to improve the industry?’ both trade associations and the government were listed. However., there were some replies which said ‘no’ to government involvement! Those who named other people or organisations predominantly gave as examples existing New Zealand export successes such as producer boards and individual industry leaders. Hardly anyone said use multinationals or overseas agents.

So it seems, as in other areas, it is up to the industry to get together, to formulate a plan, get individual company support, and then to ask government to endorse the plan with formal support, official overseas representation and presence, and possibly some funding. The world is changing, society is changing. We must take new initiatives for export. The software industry can be one such new industry for New Zealand. The potential is clearly there, and a start has been made. What is needed now is greater support for those few who are at present active in this area and for the various trade groups and societies.

We do not have enough resources to waste them in overlapping activities or in satisfying narrow sector interests. We must get behind the New Zealand software industry and make it grow.

References

Jones, Barry, Sleepers Wake, Oxford University Press, 1982

Stuart, GF and McCullock, DG, Technology and Innovation in the NZ Manufacturing Industry, DSIR, 1980

IDC Study of the Electronics Industry

OECD Committee for Information Computer and Communications Policy (ICCP). Update of Information Sector Statistics, September 1984

Some Preliminary Figures from the DSIR Survey of the NZ Software Industry, August 1984. Full DSIR Discussion Paper due for publication in April 1985